Ten tax myths revisited: 20th Anniversary retrospective

In October 1999, I wrote the report Ten Tax Myths. Any retrospective on this issue must examine the relationship between research and analysis and the question of political agency. We know that no matter how good the research and analysis, unless there is a change agent to use it, the work sits frustratingly on the shelf.

When I proposed this study I had already been beating the drum on the tax issue for almost a decade. I had prepared a two-part radio documentary called Taxes: The Second Certainty for CBC Radio’s Ideas. When it proved to be one of Ideas most popular series it confirmed what I had suspected: there was a huge appetite for progressive information and commentary about this critically important issue.

People were rightly suspicious of the shameless propaganda they were being fed by the mainstream media, corporate think tanks and right wing politicians all of whom were committed to the radical downsizing of the activist state and the trashing of the post-war social contract. But being suspicious of the same old suspects is different than being well-informed about the many aspects of the tax issue. It doesn’t help to know you’re being robbed if you can’t figure out who’s robbing you.

Strategic framing

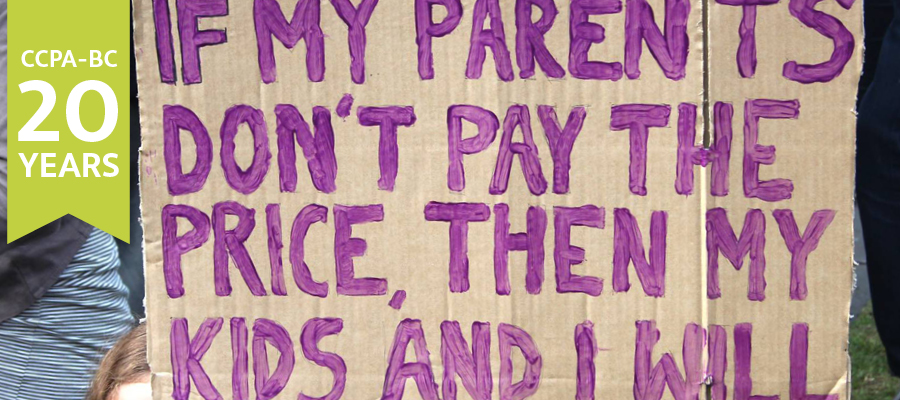

All political battles involving social issues are played out on the ground of language—strategic framing. Every time we talk about an issue, whether taxes, child care, workers’ rights or Medicare, we frame our argument either consciously or unconsciously. Those who frame the issue first and most effectively usually win the battle.

Taxes provide one of the best examples of how effective framing by the political right can undermine the voices of even those who oppose them. For many years conservatives and libertarians have consistently used the phrase ‘tax burden’ when discussing this issue. It is a calculated, strategic use of language intended to draw people into seeing taxes as an affliction—something to be cured, a burden to be relieved. And, of course, pro-business politicians are eager to comply—at the cost of social programs and equality. Unless we consciously reframe the issue—and argue that taxes are the price we pay for a civilized society—we allow the right to set the rules of debate and dominate it.

Those promoting the neoliberal counter-revolution, which began in earnest in the early 1980s, identified several aspects of government policy for special public relations treatment. Perhaps the most infamous and effective was the so-called debt crisis. For years beginning in the late 1980s there was a concerted campaign warning Canadians about hitting the debt wall. The relentless media campaign convinced many if not most Canadians that the national debt was the most important issue we faced. And (in 1995), when then Finance Minister Paul Martin slashed federal social spending by 40% there was barely a whimper. The debt terror campaign had succeeded.

For many years conservatives and libertarians have consistently used the phrase ‘tax burden’ when discussing this issue. It is a calculated, strategic use of language intended to draw people into seeing taxes as an affliction.

One of the reasons it succeeded was because there was no single social movement organization with a mandate to campaign exclusively or even primarily against this propaganda onslaught. And because Canada’s debt was relatively high, without an accessible critical analysis of the absurd notion of a ‘debt wall’ people were vulnerable. The CCPA and independent journalists did make an effort to inform, but without an organization to focus the fight and challenge the perpetrators, the right completely dominated the public discourse.

I could just as easily have called my CCPA paper “10 Tax Lies” as some elements of the neoliberal campaign were out and out falsehoods. The fact that so many myths were thrown at us spoke to the importance of the issue to the economic elite. They knew just as we did that all roads lead to government revenue: without it, social programs and income redistribution are impossible. The right calculated that it would be much easier to gut government revenue (and argue there was no money for programs) than it would to explicitly oppose Medicare, low tuition fees, social housing and Employment Insurance.

One of the more important myths that I explained in my report was “taxes are too high.” This was a meaningless generalization that nonetheless tried to suggest that we—rich and poor alike—were all in this together. Another tactic was to compare us to other developed countries with the claim that we had “…one of the highest tax rates in the OECD (Organization for Economic Co-operation and Development).” This was just plain false as Canada fell right in the middle of developed countries regarding virtually every type of tax. The argument that corporate income taxes were too high ran up against the (relatively unknown) fact that Canada had the second lowest effective tax rate (after Japan) of the G7 countries. Most importantly, the Canadian rate was 50% lower than that of the US—our only real competitor.

Propagating tax myths

In order to propagate these tax myths, The Canadian Taxpayers’ Federation was launched in Alberta in the late 1980s (and has since spread to every province), reframing the citizen as merely a ‘taxpayer’. It attacks governments that dare propose an increase to any social program or tax increases for the wealthy or corporations. It has garnered considerable media attention for the past twenty years, attention that has seldom been challenged. In some ways, this has put progressives at an even greater disadvantage than we were with the debt terror campaign.

The reception for Ten Tax Myths reinforced my conviction that the public was both eager for a counter-narrative on taxes and conscious of the progressive role that taxation plays. The report was widely read, referred to in other progressive publications and, as I recall, received a smattering of media coverage.

Again, with no organization or coalition of groups to take the fight directly and systematically to the Taxpayers Federation (or its mothership, the Reform Party) the impact of the study was limited and faded fairly quickly. This was by no means the fault of the CCPA which clearly recognized the need for an effective counter narrative and encouraged its social movement partners to use it. But those social movement partners had their own mandates to fulfil with limited resources.

The vast majority of Canadians not only understand the critical importance of taxes in providing revenue for services, but they are willing to pay more.

In 1999, the same year I wrote my paper, Liberal Finance Minister Paul Martin delivered the largest set of tax cuts in Canadian history with a five-year, $100 billion tax reduction mostly benefiting high income earners and corporations. This was possible because of huge budget surpluses following his draconian cuts to social programs. As with his earlier social spending cuts there was barely a ripple of opposition to a policy that would gut federal revenues for years to come. There was no need to philosophically oppose pharmacare, renewable energy or free tuition when all governments would now have to do is ask rhetorically where will the money come from. It took a brave politician to even hint at recovering revenue from the rich and corporations through tax increases given the anti-tax forces waiting to pounce.

Canadians for Tax Fairness

It was not until 2011, after Conservative Party Finance Minister Jim Flaherty cut income taxes by a further $60 billion and chopped two points off the GST for an additional $13 billion loss to federal coffers that my long-hoped-for social movement organization focussed exclusively on fair taxes was founded. Canadians for Tax Fairness (disclosure: I am on the board) tapped into the hunger for straight answers on tax issues and for tax justice. With just one and a half staff members it has played a key role in exposing the issue of tax evasion and the use of tax havens by the wealthy and corporations. Taking advantage of work done by the CCPA (especially through its annual Alternative Federal Budget) Canadians for Tax Fairness is garnering increased mainstream media coverage. It will be a long slog to reverse 25 years of right-wing dominance of the tax issue, but we now have an informal partnership worthy of the challenge.

What else has changed since Ten Tax Myths was published?

Important work by the CCPA-BC has demonstrated decisively that the vast majority of Canadians not only understand the critical importance of taxes in providing revenue for services but they are willing to pay more. The key to this positive response was CCPA framing of questions in surveys and focus groups. When people were given the option of paying higher taxes for specific social objectives (child care, ending homelessness, Pharmacare, ending child poverty) between 50 and 69% were willing to pay more taxes (depending on the policy option). Even a majority of Conservative Party supporters expressed a willingness to pay more.

In 1999 the prospects for fighting for tax fairness were pretty grim. In 2017 I think we have turned the corner on this all-important struggle.

Topics: Economy, Privatization, P3s & public services, Taxes