Why Canada still needs a wealth tax—and what it could fund

The rise of extreme inequality has provoked growing calls for an annual wealth tax on the super-rich around the world, and Canada is no exception.

Backed by a growing body of economic research, proposals for a wealth tax have high levels of support among Canadians across party lines. Yet, an annual wealth tax is nowhere to be seen on the federal government’s agenda.

Based on up-to-date modelling of a moderate wealth tax, my analysis shows this tax could provide a huge source of ongoing revenue for public investment while helping to rein in extreme inequality.

Prior to the COVID-19 pandemic, CCPA research showed that the 87 richest families in Canada each held, on average, 4,448 times more wealth than the typical family—and more than the 12 million Canadians at the bottom of the economic ladder combined.

The Parliamentary Budget Office estimates that the richest 1% in Canada controls 25% of the country’s wealth. Recent academic estimates have put that figure even higher at 29%.

During the COVID-19 pandemic, billionaire wealth continued to skyrocket in Canada and around the world. At the time of writing, 61 Canadian billionaires alone now control $324 billion in wealth. Some of the same super-rich benefitted as owners of large corporations amid ballooning corporate profits, which rolled in even as inflation rose rapidly and Canadians struggled with an escalating cost of living.

A wealth tax has high levels of support among Canadians across party lines.

This type of extreme inequality has damaging consequences: economic, social and political.

High levels of inequality hurt economic growth as organizations like the IMF and OECD have begun to acknowledge in recent years. Inequality is linked to worse performance on a wide range of health and social outcomes as international epidemiological research shows. Economic inequalities also contribute to inequalities in political influence, which skew public policy priorities towards the preferences of the rich, deprive governments of revenue for public investments and reinforce the concentration of wealth.

It’s no surprise that wealth taxes have risen to prominence under these circumstances, sparked by proposals from US Senators Bernie Sanders and Elizabeth Warren. In Canada, the federal NDP has put forward a proposal for a wealth tax, albeit a much smaller one than proposed by Sanders or Warren.

A slew of new economic research on wealth taxes has emerged in the past few years, showing that a well-designed wealth tax has the potential to be efficient and effective, help reduce extreme inequality and raise a large amount of revenue for public investment. An early wave of research was spearheaded by economists Thomas Piketty, Emmanuel Saez and Gabriel Zucman and quickly extended more broadly including a large body of evidence assembled by the UK Wealth Tax Commission.

Revenues from a federal wealth tax in Canada

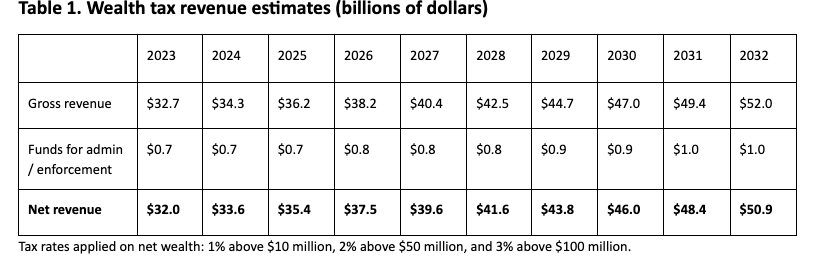

In the Canadian context, how much revenue could a moderate annual wealth tax raise? I have modelled revenues for a wealth tax applying to net wealth above a threshold of $10 million with three brackets and rates: 1% above $10 million, 2% above $50 million and 3% above $100 million.

Net wealth is defined as total assets (including financial assets, real property, etc.) minus any outstanding debts (including mortgages). Under this tax structure, the first $10 million of net wealth for any family is unaffected: only the portion of wealth above the threshold is taxed. A household “merely” in the wealthiest top 1% is not rich enough to be impacted by this tax, which affects only about the richest 0.5% in the first year, representing roughly 87,000 families. An even tinier share are affected by the higher brackets: roughly 8,500 families with wealth above $50 million and 3,100 above $100 million.

A wealth tax of this kind in Canada would raise an estimated $32 billion in the first year alone. This would rise to an estimated $51 billion by the tenth year and a cumulative $409 billion over ten years.

In estimating these revenues, I use an updated version of the High-net-worth Family Database from the Parliamentary Budget Office, which models wealth distribution in Canada. My estimates are informed by the latest research from academic economists specializing in wealth taxes.

The wealth tax structure suggested here goes beyond the smaller tax proposed by the NDP in the last federal election, which would apply a 1% rate to net wealth above $10 million with no further brackets. But even this smaller wealth tax would be an important step and raise significant revenue: an estimated $19 billion in its first year, $31 billion by the tenth year and $246 billion over a 10-year window.

The US-based proposals for a wealth tax from Sanders and Warren would go much further, applying rates as high as 6% on wealth over $1 billion and 8% over $10 billion. More aggressive wealth tax proposals of these kinds should be part of the debate in Canada, too. They would be needed to make a lasting dent in the fortunes of the wealthiest few. Still, for a small country like Canada, acting as a first mover by implementing a wealth tax, imposing moderate rates rising to 3% may be a sensible place to start.

Is a wealth tax enforceable?

Can a wealth tax withstand the efforts of the rich to avoid it? The growing economic research on this question says yes. As leading economists like Saez and Zucman emphasize, levels of tax avoidance and evasion are not laws of nature, but rather are determined by policy choices. We largely know how to crack down on tax avoidance and evasion, but what’s too often been missing is political will.

Some key design features of a wealth tax are essential to make it effective and enforceable. For example, a modern wealth tax must be comprehensive, applying equally to all types of assets so there is no incentive to shift wealth into asset classes that are exempt from the tax (e.g., no special exemptions for privately held businesses or primary residences, which weakened some older European wealth taxes). Third-party reporting of assets from financial institutions must be mandatory, building on the type of capital gains income reporting already required under the existing income tax system.

The Sanders and Warren wealth tax proposals also include a steep “exit tax” of 40% on expatriation, an approach which could be applied here in recognition of the contribution of Canadian society to creating huge fortunes. Alternatively, the UK Wealth Tax Commission suggests a design in which annual wealth tax obligations continue to apply for a set number of years in cases of emigration. Focusing wealth taxes on the super-rich—as discussed above, only about 87,000 families in Canada initially—also makes it easier to carry out frequent audits, which would become an ongoing threat for attempted tax shirkers.

Recent economic research discusses these design and enforcement questions in more detail (including ingenious approaches to issues like arriving at valuations for large privately held businesses).

Still, to be cautious, the wealth tax revenue estimates above already incorporate the assumption of some leakage through tax avoidance, evasion and other behavioural responses. Specifically, I reduce the tax base to account for such responses in line with the economic research on wealth taxes. The rate used by Saez and Zucman based on their survey of the wealth tax literature is 16%, though they emphasize this should be considered an “upper bound” and that well-designed and enforced wealth taxes should be able to achieve lower levels of behavioural response. Indeed, the UK Wealth Tax Commission tended towards a lower estimate, with a suggested range of 7-17% for that country, and recent research examining the potential for a European Union-wide wealth tax also arrived at a lower estimate.

As another layer of conservatism, my revenue estimates above have also deducted 2% to ensure a very generous allowance for administration and enforcement of a wealth tax ($654 million in the first year and rising). The effectiveness of stronger tax enforcement on the rich and large corporations—with or without a wealth tax—is underlined by a variety of recent analyses from the Parliamentary Budget Office, which suggest each dollar invested in tax enforcement pays back multiples in revenue generated.

Taxing the super-rich to invest in the common good

There’s no shortage of badly needed public investments that a wealth tax could help fund.

Let’s put in context the main revenue estimates above: namely, that a federal wealth tax on the richest few could raise $32 billion in revenue in its first year and $409 billion over 10 years.

That’s enough to pay for universal public pharmacare, free tuition for postsecondary education, 100,000 non-market affordable homes each year and a major increase in public transit investment combined. Each of these investments would also have significant knock-on benefits for the Canadian economy.

This is just one set of possible uses of these revenues among many.

To be sure, a wealth tax isn’t a panacea in the fight against extreme inequality nor as a source of government revenue. On tax policy alone, a suite of complementary measures are also needed. These include ending the special treatment of capital gains income, increased tax rates on the highest incomes, raising corporate tax rates, taxing wealthy landowners and investing in tax enforcement. Beyond tax policy, Canada also needs—among other things—stronger labour standards, higher minimum wages and more union organizing by workers to increase their power in the workplace.

Proposals for a wealth tax enjoy massive and consistent public support in Canada, reaching 89% in national polling including 83% of Conservative voters. Despite this level of popularity, the wealthy in this country have so far seemingly managed to keep it largely off the policy agenda.

Such a stark disconnect between public opinion and public policy points to a broader deficiency in our democracy, which requires concerted working-class and social movement organizing to overcome. If that movement power can be built, the policy tools to fight extreme inequality are at our fingertips.

Notes

1. Based on Forbes’ Real-Time Billionaires list as of March 16, 2023.

2. I use the latest Statistics Canada population data and the National Balance Sheet Accounts (NBSA) data (Q4 2022) to bring the 2016 version of the Parliamentary Budget Office’s (PBO) High-net-worth Family Database (HFD) up to date in terms of wealth aggregates. See page nine of PBO’s June 2020 report for a full description of how they describe updating their 2016 HFD data set using these same population and NBSA data series from Statistics Canada. To project ahead for the 10-year revenue window, I follow the approach used by economists Emmanuel Saez and Gabriel Zucman in their revenue estimates for Elizabeth Warren’s wealth tax proposal. Specifically, I assume that the wealth tax base (household net worth) will increase at the same rate as nominal GDP growth, even though net worth has actually risen more rapidly than nominal GDP growth over the past three decades. To grow the wealth tax base, I use the nominal GDP growth rates from the PBO’s Economic and Fiscal Outlook projections for 2023-2027 and assume lower nominal GDP growth of 3.8% in the subsequent five years. Given that household net worth actually grew at an average nominal rate of about 6.8% over the past three decades, it is reasonable to project continued nominal growth in the wealth tax base of at least 3.8%, even after applying annual wealth tax rates as high as a 3% on net worth over $100 million each year.

3. For a given year, my estimates for revenues from a moderate wealth tax reduce the tax base by 16% to account for behavioural responses such as avoidance and evasion, which follows Saez and Zucman’s approach in estimating revenues for a more aggressive US wealth tax with higher tax rates. They emphasize that this figure should be understood as an “upper bound,” and in this respect my revenue estimates are conservative. In its own estimates of wealth tax revenues in Canada, the PBO applies a larger 35% behavioural response rate, but this is not in line with the wealth tax literature. See the next section for more on the research literature on behavioural responses.

4. For the smaller 1% wealth tax, I apply a slightly lower 12% behavoural response rate to reduce the tax base, which is the midpoint of the 7-17% range estimated by the UK Wealth Tax Commission for a 1% wealth tax.