BC budget does the right thing by prioritizing investment over austerity

BC’s first budget under Premier David Eby includes substantial funding increases in housing, health care, income supports and cost of living tax credits, as well as allocating a record level of investment towards capital infrastructure. This not only represents much-needed progress towards meeting some of the big challenges facing our province but also prudently continues to invest in the public good rather than cave to fear-mongering about deficits in light of the economic slowdown.

The budget projects modest deficits over the next three years: $4.2 billion in 2023/24 and $3.8 billion and $3 billion in the subsequent two years. While these numbers may sound big, they represent about 1% of the provincial economy (or GDP) in 2023/24 and slightly less thereafter.

Deficits are entirely appropriate with an economic slowdown underway. They are also far preferable to inadequate investment in critical public services and infrastructure, which leads to its own kind of deficits—social and environmental—as the CCPA has long argued (and as Premier Eby noted recently).

An eventual return to budget balance should come via increased revenue, not by neglecting public investment, which would be costly to BC’s social and economic well-being in the long run.

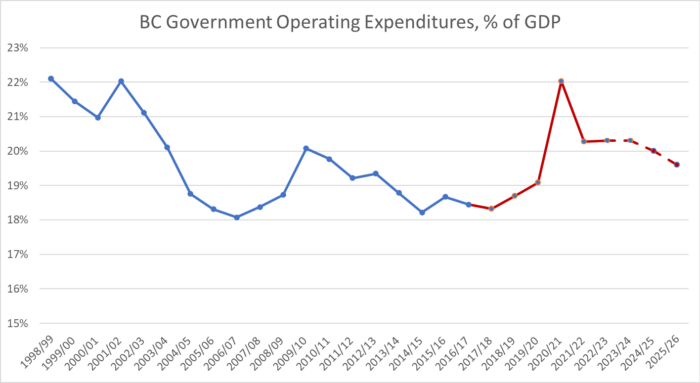

Even with the expenditures in Budget 2023, provincial operating spending as a share of GDP (the size of the provincial economy) has declined substantially from where it stood 25 years ago—in part a consequence of severe social spending cuts under the previous BC Liberal government. Spending by this measure had largely leveled off since the BC NDP came to power, with the exception of a temporary jump during the pandemic. With Budget 2023, it will inch back up compared to pre-pandemic levels.

Even so, if spending in 2023/24 returned to the levels of two decades ago (as a share of GDP), we’d have about another $5 billion available to invest in priority areas this year alone. A return to those levels of public investment could be funded in part by more robust taxes on high incomes, corporations and wealthy landowners, with the dual benefits of generating revenue and reducing inequality.

The budget also shows a reduction of the huge projected surplus for the current 2022/23 fiscal year, which the government has partly spent on an array of one-time funding announcements in recent weeks. As of budget day, a hefty $3.6 billion surplus remains, but the Minister of Finance indicated that more funding announcements are still to come before the March 31 cutoff. Deficits are entirely appropriate with an economic slowdown underway.

This is a challenging budget to summarize because it includes positive investments in quite a large number of areas, though there are notable gaps as well. Here is some initial analysis.

Housing

The budget includes important new investments in housing totalling $4.2 billion over three years. This includes both operating and capital funding for building new homes through Building BC and BC Housing programs, as well as funding for supportive housing and “multi-disciplinary teams” to address encampments and help people access temporary modular housing.

There are also some hints in the budget at addressing municipal-level housing roadblocks, which make providing new homes more difficult and expensive for public, non-profit and private rental developers alike. This includes $57 million “to unlock more homes through new residential zoning measures and by reducing the time and cost associated with local government approval processes.” The recently passed Housing Supply Act will also be crucial to this aspect of the government’s housing agenda. The legislation has teeth, but the government must use them.

The new housing measures build on recent announcements such as a $500 million Rental Protection Fund, which will help to purchase and bring some private rental buildings into the non-profit sector. Earlier this month, the province also announced $1 billion in funding to municipalities for investment in infrastructure as it presses municipalities to ramp housing starts. Both of these measures are funded out of the large surplus in the current fiscal year.

Does this suite of housing measures meet the huge backlog of need for homes, amid a severe housing shortage and ultra-low vacancy rates squeezing renters at every turn?

Likely not, but it’s currently difficult to say. That’s because the budget lacks important details, including how many new non-market homes the government aims to bring online with the increased funding. Rather, the budget notes that a full-fledged housing plan will be released this spring by Housing Minister Ravi Kahlon.

The CCPA has recommended that the province create 25,000 new public and non-market homes each year, alongside an overall increase in housing supply. The government has the ability to create non-market rental housing for the middle class on a model that largely or entirely pays for itself. The nascent BC Builds program should be harnessed to this end, and we hope to see this in the plan when it is released.

Affordability measures and poverty reduction

Budget 2023 uses a variety of measures to put additional money in the pockets of British Columbians struggling with the rapidly rising cost of living.

These include the long-awaited “renters rebate” in the form of an income-tested tax credit, valued at $400 per year for households with incomes up to $60,000 (with households earning up to $80,000 receiving a partial credit). Importantly, this tax credit is refundable, meaning that British Columbians whose income is too low to owe provincial taxes will still receive the credit. The government could create non-market rental housing on a model that largely or entirely pays for itself.

Notably, the $300 million annual expenditure on the Renter’s Tax Credit still pales in comparison to the long-standing $900 million outlay on the Home Owner Grant, which is not income tested and has a higher base amount of $570 per household.

Budget 2023 also announces a welcome permanent increase in the BC Family Benefit, after one-off increases for the months of January, February and March 2023. This key benefit for lower-income families with children had previously been frozen at a maximum of $1,600 per year since its introduction in October 2020, which means that its real value eroded with inflation. The newly announced increase restores the real value of the benefit to its 2020 level, with a welcome additional increase for single parents. However, if this benefit does not get indexed to inflation next year, its value will once again erode over time.

The climate action tax credit also receives a boost of just over $400 million. The maximum amount received by adults more than doubles to $447 per year and for each child nearly doubles to $111.50. The income threshold for families is also being increased so that more families will be eligible for support. The credit amounts will continue to rise along with the carbon tax in the years ahead, with the government saying that a “significant majority of British Columbians are projected to receive more through the enhanced credit than they pay in increased carbon tax costs by 2030.” For now, the budget notes that households with incomes under $60,000 will typically receive back more in the credit than they will pay in carbon tax in a given year.

A surprise in the budget (though long overdue) was a $125 per month increase to shelter allowance for people receiving income assistance (“welfare”) and disability benefits. That monthly shelter rate will now become $500 per month. The prior rate of $375 per month had become an embarrassment given the huge rises in rents in BC in recent decades. The increase announced in Budget 2023 is desperately needed, and recipients will also benefit from the Renter’s Tax Credit.

But the higher shelter rate still pales in comparison to the scale of rent affordability challenges people are facing. Furthermore, because the increase comes to the shelter allowance rather than the overall rates, unhoused people and some of those in subsidized housing won’t receive the increase, despite the record-high jump in the cost of living last year. Bottom line: British Columbians who rely on income assistance and disability benefits will continue to be kept in deep poverty. Rates should instead be increased to the poverty line.

It’s good to see increases in some of the other supplements available for people receiving welfare and disability assistance, such as those to meet food and clothing needs, the school start-up supplement for children and the Christmas supplement. These modest supplements have been frozen for years despite increasing costs.

Other welcome announcements include: free prescription contraception; higher financial supports for foster caregivers; some improvements in student loan repayment terms for those earning low incomes; more funding for school food programs; funding to support the implementation of BC’s new anti-racism legislation and some money to support immigrant settlement services and foreign credential recognition.

Public services

Another area of significant investment in Budget 2023 is health care, with $6.4 billion in new spending over the next three years. We are encouraged to see that the BC government is strengthening the public system at a time when others in Canada are using the current strains as an excuse for privatization—a path we know leads to more expensive and poorer quality care.

The new health care funding commitments include a recently announced investment in cancer care ($270 million over three years), as well as a much-needed workforce plan to recruit, retain and train new health care workers ($1 billion) amid widespread staffing shortages. Another $1.1 billion goes to the new payment model for family doctors announced late last year. A shortcoming of this model is that it is not geared to facilitating the expansion of community health centres, which should be a lynchpin of a strong primary care system.

The budget also adds $867 million in new funding towards mental health, addictions and treatment services over three years, including new treatment beds and “a new model of seamless care to support people through their entire recovery journey from detox to treatment to aftercare.” This may sound like a big number but it is barely scratching the surface given the extremely limited support for mental health currently. It is positive that the new treatment beds will not have user fees, but more detail or action is needed to understand what the province’s plans are with respect to existing beds that will continue to have fees attached. We are encouraged to see that the BC government is strengthening the public system.

BC needs a drastic expansion of access to “safe supply”, which is critical to preventing toxic drug deaths and their devastating impact on communities.

A notable gap, however, is seniors care. Home care services (including help daily living needs like cooking and groceries) in particular, along with greater access to well-staffed, publicly-owned long term care, are vital to seniors quality of life. Investments in these services also reduces pressure on the much more costly acute care (hospital) system.

On the child care front, Budget 2023 is surprisingly quiet, but seemingly only because big multi-year funding increases and fee reductions were already announced last year. As we noted in the lead up to the budget, child care spaces are still scarce and early childhood educators (ECEs) remain poorly paid and in short supply. The government needs to fast-track prior commitments to implement a wage grid for ECEs to support recruitment and retention and to increase capital investment in new public and non-profit spaces, while stopping the expansion of the private, for-profit child care sector.

The K-12 education sector faces its own staffing shortages, but there was little in the budget to address this, though a recent improvement in the teachers’ salary grid may help.

Climate change

The budget plans for ongoing increases to the carbon tax rate of $15/tonne per year (in line with federal requirements), which remain a centrepiece of BC’s climate plan. As discussed above, the increases are coupled with a big and welcome ongoing increase to the climate action tax credit to offset costs to households—in line with what we at the CCPA–BC have long recommended.

A smattering of other climate measures include $100 million for active transportation, $100 million per year in capital funding to replace infrastructure damaged from climate emergencies and $85 million over three years for emergency response planning. Despite these steps, as the BC Climate Emergency campaign puts it, “the provincial government remains a long way from spending what it takes to confront the climate emergency.”

Investment not austerity

Our province is facing big social and environmental challenges—sky high rents, health care under enormous strain, a toxic drugs crisis, climate disruption and the need to rebuild crucial but eroded public services (to name a few). The good news is that Budget 2023 rightly prioritizes badly needed investments over a return to austerity.

While this might not please corporate interest groups, it responds to what the rest of us need. A single budget couldn’t possibly solve these problems overnight but BC Budget 2023 is an important shift in the right direction.

Still, as multiple crises persist, “shifts in the right direction” won’t be enough unless they are ramped up to match the scale of these crises. Investments need to be sustained and increased to achieve meaningful and visible progress on the ground: lower rents, quicker access to quality public health care, fewer toxic drug deaths, more $10/day child care spaces and less climate pollution (among many others). This is no small task after decades of underinvestment and outright cuts by previous governments that eroded the public sector’s capacity to do big things. But we are an extremely wealthy province and have the resources and talent to meet these challenges if the political will is there.

Topics: Children & youth, Climate change & energy policy, Economy, Education, Health care, Housing & homelessness, Poverty, inequality & welfare, Provincial budget & finance, Taxes