Wealth tax would raise far more money than previously thought

While the lives of millions of working people have been upended by the COVID-19 pandemic, the wealth of the richest few has continued to balloon in Canada. A wealth tax on the super rich is an important policy needed to address extreme inequality and help raise revenue for sustained, long-term increases in public investment in key areas after the pandemic.

Inequality has reached new heights in Canada in recent years. The richest 1% now control 25% of Canada’s wealth, according to a recent Parliamentary Budget Office (PBO) report. Research from the Canadian Centre for Policy Alternatives shows that the 87 richest families in the country each hold, on average, 4,448 times more wealth than the typical family. Together these 87 families hold more wealth than the bottom 12 million Canadians combined.

Inequality is linked to worse performance on a wide range of health and social outcomes, as international epidemiological research shows. High levels of inequality also damage economic growth, as organizations like the IMF and OECD have begun to acknowledge in recent years.

Inequality has reached new heights in Canada in recent years.

Tackling inequality with a wealth tax on the super rich is hugely popular, backed by an overwhelming majority of Canadians across party lines in the most recent polling. This approach is also supported by a growing body of economic research and analysis.

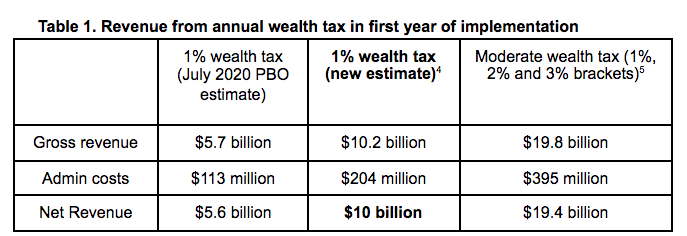

This paper provides a new estimate of the revenue potential of a wealth tax using up-to-date national accounts data and estimating tax avoidance and evasion based on the latest academic research. A 1% tax on wealth over $20 million in Canada would generate about $10 billion in revenue in its first year, substantially more than the commonly cited estimate of $5.6 billion.

With a $10 billion boost to annual public revenues, Canada could lift hundreds of thousands of people out of poverty, implement long-term increases to funding for important social programs like child care, health care and seniors care, and help pay for more ambitious climate action.

(See the CCPA’s Alternative Federal Budget 2019 and AFB Recovery Plan for program options and costing, as well as a range of other measures to raise additional revenue.)

A moderately more ambitious wealth tax could reduce inequality further and fund additional investments. For example, a wealth tax with rates of 1% on net worth over $20 million, 2% over $50 million and 3% over $100 million could raise nearly $20 billion in its first year.

A 1% tax on wealth over $20 million in Canada would generate about $10 billion in revenue in its first year.

Wealth taxes of these kinds, targeted to net worth over $20 million, would apply to only about 25,000 wealthy families, representing the richest 0.2% of the country. This tiny fraction of Canadians—the richest of the rich—together control $1.8 trillion of the country’s wealth.

Notably, these wealth tax rates do not even approach the much higher rates called for by Bernie Sanders and Elizabeth Warren in the United States. Their more aggressive plans would apply rates as high as 6% on wealth over $1 billion and 8% over $10 billion.

A wealth tax is just one piece of the puzzle when it comes to tackling inequality and raising revenue for important public investments. It should be accompanied by a suite of other tax fairness policies, including ending the costly special treatment of capital gains income in the Canadian tax system and closing a range of other tax loopholes that benefit the affluent.

Updated wealth tax revenue estimates: the details

This paper’s updated estimates of wealth tax revenue corrects for two limitations in the most recent and commonly cited wealth tax revenue estimate from the Parliamentary Budget Office (PBO) in July 2020, while maintaining the core of PBO’s methodology.

First, the PBO’s July 2020 estimate of wealth tax revenues reflected a large drop in asset values early in the pandemic (a factor that the PBO acknowledges in its publication). Asset values have since then rapidly bounced back in Canada. In the current estimates, I use the most recent Statistics Canada data to update the PBO’s wealth data set. This is done using the methodology that the PBO provides in an earlier report for updating their wealth distribution data set.1

When the latest aggregate wealth data is used, this adds $800 million to the projected net revenue for a 1% wealth tax compared to the earlier PBO estimate of $5.6 billion.

Second, and more significantly, the PBO assumed that 35% of the wealth tax base would be wiped out by “behavioural responses” such as tax avoidance and evasion. 2 However, this estimated behavioural response rate is out of line with the latest economic research on wealth taxes.

Levels of tax avoidance and evasion are not laws of nature.

Surveying academic studies of European wealth taxes, University of California, Berkeley economists Emmanuel Saez and Gabriel Zucman estimate a substantially lower average behavioural response of 16%. Furthermore, they suggest that this figure should be understood as an “upper bound.” That is, behavioural responses to these European wealth taxes were higher than they needed to be as a result of policy design flaws that can be readily avoided.

As Saez and Zucman emphasize, levels of tax avoidance and evasion are not laws of nature, but rather they are determined by policy choices. In its published estimates of wealth tax revenues, the PBO rightfully acknowledges a high level of uncertainty about behavioural responses. But much of this uncertainty is driven by policy choices that serve to protect the wealthy and can be changed. I say more on the proper design and enforcement of a wealth tax below.

Notably, Saez and Zucman applied their 16% behavioral response estimate to the much more aggressive wealth tax proposals of Bernie Sanders and Elizabeth Warren, which use higher tax rates than have so far been proposed in Canada. We would expect a smaller behavioural response to a well-enforced wealth tax at the low 1% rate proposed by the federal NDP.

An extensive new body of research produced by the UK Wealth Tax Commission, based out of the London School of Economics, reinforces this view. For a 1% annual wealth tax in the United Kingdom, the Commission’s review of the evidence suggests a 7-17% behavioural response rate.

Using behavioural responses that are in line with the scholarly economic research on wealth taxes yields substantially larger projected revenues than the earlier PBO estimate.

Much of this uncertainty is driven by policy choices that serve to protect the wealthy.

For a small 1% wealth tax, this paper uses the midpoint of the UK Wealth Tax Commission’s 7-17% behavioural response range, applying a 12% reduction in the wealth tax base. This yields net revenues of $10 billion in the first year of the tax. If we use behavioural response estimates across the full 7-17% range, revenues vary from a high of $10.8 billion to a low of $9.2 billion.

Table 1 shows the estimates of the gross revenue, administration costs and net revenue for the 1% annual wealth tax, alongside the PBO’s older revenue estimate.

I also include estimated revenues for a moderately more ambitious wealth tax with additional brackets (1% over $20 million, 2% over $50 million and 3% over $100 million), using Saez and Zucman’s higher 16% behavioural response to be more conservative in the estimate. This moderate wealth tax would raise an estimated $19.4 billion in net revenue in its first year (net of administration costs), though this estimate has a higher level of uncertainty.3

Following the PBO’s methodology, I have deducted 2% of gross revenues for administrative costs. In absolute terms, these estimates allow for administrative costs nearly double those earmarked by the PBO for a small wealth tax ($204 million compared to $113 million), which double again for a moderate wealth tax. This approach adds a layer of conservatism to my net revenue estimates and allows for substantially more investment in enforcement. These administrative costs are a drop in the bucket compared to $10 billion or $20 billion in revenue.

Enforcing a wealth tax

The use of tax havens and other large-scale tax avoidance and evasion is often assumed to be inevitable, whether it relates to a wealth tax or the existing tax system. But, as economists like Saez and Zucman emphasize, we largely know how to crack down on this behaviour and how to design a wealth tax that minimizes it. What’s been missing is the political will to challenge the interests of the wealthy and powerful who oppose these steps.

Would Canada’s super rich flee the country to avoid a wealth tax? Some may, but a well-designed wealth tax will not allow them to dodge their tax obligations in this way. As in the Elizabeth Warren and Bernie Sanders wealth tax proposals, a steep “exit tax” can be applied on expatriation, in recognition of Canadian society’s contributions to these fortunes. Exit tax rates are set at a rate of 40% in the Warren and Sanders plans and could be set even higher.6 The UK Wealth Tax Commission suggests a similar policy design in which wealth tax obligations continue to apply to the super rich for a set number of years after emigration.7

Nor will simply shifting assets to low-tax jurisdictions get the super rich off the hook—at least in terms of legal obligations. Modern wealth tax proposals apply to net worth worldwide.

The biggest concern is that the wealthy will engage in outright criminal tax evasion, flouting the law to hide or misreport their wealth in tax havens. Ramping up tax enforcement and cracking down on tax avoidance and evasion is critical if we are going to make a wealth tax work. The good news is that, as Saez and Zucman emphasize, we already know how to crack down.

The biggest concern is that the wealthy will engage in outright criminal tax evasion.

Key measures include increasing funding for enforcement efforts focused on the rich, steeper penalties for tax evasion, enforcement against financial services providers that help organize and enable evasion, and imposing stronger transparency and third-party reporting requirements on financial institutions doing business with Canada. Focusing a wealth tax on a narrow band of the richest 0.2% also facilitates a high rate of audits. The growing body of economic research on wealth taxes outlines the various practicalities of enforcement in more detail.

The scope of a wealth tax is also important to enforcement. A modern wealth tax should be applied equally to all types of assets, so there is no benefit to shifting wealth between asset classes. This is a lesson learned from some older European wealth taxes, which often made the mistake of exempting certain assets like primary residences. This was done with the intention of protecting the upper middle class because these taxes applied at much lower wealth thresholds.

However, a wealth tax focused on the super rich avoids these problems by exempting the upper middle class and what Saez and Zucman call “the merely rich,” eliminating the rationale to exclude certain assets. Of course, the “merely rich” can and should be taxed by other means.

Major new tax enforcement efforts should be undertaken with or without a wealth tax. The PBO estimates that recent federal investments in business tax enforcement alone (which are modest and should go further) have had a fiscal impact of nearly six dollars for each dollar spent on enforcement, plus a further boon to provincial revenues. The fact that these steps weren’t taken sooner, and that stronger enforcement efforts aren’t being immediately implemented, is a testament to the power of the wealthy in our politics.8 PBO analysis has suggested that the federal “tax gap” relating to tax havens may be as high as $25 billion in lost revenue.

Tackling the super rich and funding the public good

When it comes to taking on the super rich and expanding public services, a wealth tax is only one piece of the puzzle. In the area of tax policy, a range of additional measures are needed.

First, Canada needs to end the preferential treatment of income from wealth (i.e., capital gains from stocks, real estate, etc.) compared to income from work. Currently, capital gains are taxed at half the rate of income from work, costing billions of dollars in lost public revenue. Ninety-two per cent of the benefits from this policy flow to the top 10% of income earners. Recent estimates from University of Toronto economist Michael Smart suggest that closing this loophole could raise nearly $16 billion in annual revenue to federal and provincial governments.

Canada should also end a proliferation of other tax expenditures that disproportionately benefit the affluent, reform corporate taxation based on innovative models, implement an inheritance tax on estates over $5 million, and substantially raise the top marginal income tax rate.

But a wealth tax can play a unique role by honing in on the richest of the rich. While a broader group like the top 10% of income earners can afford to pitch in more to help increase public investments, they will be more willing to do so if the wealthiest 0.2% are paying their fair share.

Canada should also end a proliferation of other tax expenditures that disproportionately benefit the affluent.

If one of our goals is to begin confronting and reversing the massive concentration of economic power in this country, a wealth tax is needed alongside other tools of fair taxation.

Of course, the tax system itself is only part of the solution. A whole range of other actions are necessary to take on extreme wealth and equalize economic power in Canada, including the strengthening workers’ rights and new models of public, employee and community ownership.

Taxing the super rich enjoys overwhelming public support among Canadians across party lines. So why is a wealth tax not front-and-centre in our politics? Governments do pay attention to public opinion, but when the interests of the wealthy few are at stake, the will of the majority often doesn’t translate into substantive policy change.

The economic and political power of the super rich is real. But there has always been an answer to organized money: organized people. Building on a deep well of public support and backed by a growing body of research, a wealth tax can be won if Canadians get organized to demand it.

Acknowledgements

Thanks to Gabriel Zucman, Rob Gillezeau and Rhys Kesselman for comments on earlier drafts of this paper.

Notes

1. Specifically, I use the latest Statistics Canada population data and the National Balance Sheet Accounts data (Q3 2020) to bring PBO’s High-net-worth Family Database (HFD) up to date. See page nine of PBO’s June 2020 report for a full description of how they describe updating their 2016 HFD data set using these same population and NBSA data series from Statistics Canada.

2. In brief, they scale down the aggregate wealth totals on their High-income Family Database by 35% before applying the 1% tax.

3. As marginal rates get higher, uncertainty about the magnitude of behavioural responses grows as there are fewer historical cases to draw upon. On the other hand, as Saez and Zucman emphasize, behavioural responses are largely conditioned by policy choices that can be changed. More on this below.

4. As described in the main text, this estimate includes a 12% reduction in the tax base due to behavioural response, which is the midpoint of the UK Wealth Tax Commission’s range of 7-17%. Across this full range of behavioural responses, revenues vary from a high of $10.8 billion to a low of $9.2 billion.

5. Rates of 1% on net worth over $20 million, 2% over $50 million and 3% over $100 million. The revenue estimate incorporates a 16% reduction in the tax base due to behavioural response, following Saez and Zucman’s estimates for wealth taxes with higher rates.

6. Another design option would be to have the wealth tax continue to apply to super rich Canadian citizens indefinitely even when they live and work abroad (with a credit applied for any foreign wealth tax paid), similar to how the US requires citizens abroad to continue to file and pay taxes.

7. Another set of responses to consider are wealthy foreign citizens considering moving to Canada, or prospective immigrants aspiring to great wealth. Will they be dissuaded from moving to Canada if a wealth tax is implemented? Some may be, particularly if they aim to possess enormous wealth, enjoy the benefits of living in Canada, but balk at making the modest contribution required by the wealth tax. At the same time, other talented prospective migrants may be attracted by the chance to live in a more equitable, productive and well-functioning society that implementing a wealth tax would help fund. Note that migration responses are a separate question from the many existing incentives and reasons to invest in Canada, including access to a highly-skilled and educated workforce, advanced infrastructure, and public health care for employees, among other attractive features. Making new, highly-productive public investments in areas like child care, education, and infrastructure would contribute to further attracting private investment, as well as helping to unleash the economic and human potential of more Canadians.

8. The PBO report also notes that these investments in enforcement are set to decline in the coming years.

Topics: COVID-19, Economy, Poverty, inequality & welfare