Employer Health Tax refinements good news for public services, non-profits

Just over a month before the new Employer Health Tax comes into effect, we have some of the final details of the tax’s design at hand.

The provincial government released implementation details for the tax (EHT) over the summer and introduced legislation to enact it last month. The EHT replaces the deeply unfair Medical Services Plan premiums.

As I wrote back in March, by eliminating MSP premiums and replacing them with a payroll tax on employers, BC is catching up with most of the rest of the country. MSP premiums were cut in half on January 1 of this year and will be eliminated on January 1, 2020. The EHT kicks in as of January 1, 2019. (The claim that this amounts to a year of “double-dipping” in 2019 doesn’t hold water, as I discuss in my previous post.)

We at the CCPA have long argued that MSP premiums are BC’s least fair tax and should be scrapped (and the revenue replaced by another tax). That’s because whether you make $45,000 or $450,000, you pay the same flat dollar amount in MSP premiums (though those with very low incomes get assistance).

Rising MSP premiums are a part of the reason overall tax fairness was eroded so badly in BC between 2000 and 2016—along with income tax cuts that overwhelmingly favoured the wealthiest few. So eliminating MSP premiums is a big step towards restoring fairness to BC’s tax system.

Eliminating MSP premiums is a big step towards restoring fairness to BC’s tax system.

The EHT creates a more level playing field for businesses and increases the purchasing power of households, which, from a business perspective, means more customers. Small business does well under the EHT because the large majority of small businesses will be exempt. According to government estimates, 96% of revenues will come from the largest 5% of employers. Moreover, after implementing the EHT, BC will still have low payroll taxes compared to other provinces (and Canada already has among the lowest payroll taxes across the entire OECD).

In my initial post, I flagged some outstanding issues that needed to be resolved and we now have some answers on these points. The solutions offered are largely sensible, though there is one exception.

The EHT applies to large employers of all kinds, including public sector bodies like school districts, universities and health authorities, for which the Province is the ultimate funder. These employers will realize substantial savings from the elimination of MSP premiums as they typically covered MSP for their employees. But some will end up paying more overall in EHT than they did in MSP. To address this, the government pledged this past summer to provide compensatory funding to ensure there are no “cuts by stealth” resulting from the switch from MSP to EHT.

Municipal governments have also pressured the Province to provide them with similar compensation. Some municipalities will realize a net savings under the shift from MSP to EHT while most will face modest cost increases that would have to be absorbed or covered by small property tax increases. The provincial government has declined to provide compensation to these municipalities. This is reasonable, because unlike school districts or health authorities, municipalities can control how much revenue they raise. And, as I’ve explored elsewhere, BC has unusually low residential property taxes (which may sound benign, but actually serves as added fuel to the housing crisis).

Another significant change to the EHT design relates to charities and non-profits.

In general, an employer must pay the EHT if its payroll is above $500,000. They will only pay the full rate if their payroll is above $1.5 million. But, as in other provinces, charities and non-profits will get a break. The Province announced last summer that if charities and non-profits have a payroll under $1.5 million they’ll pay no EHT, and the full rate only kicks in for those with a payroll above $4.5 million. The thresholds apply separately to each branch location of a charity or non-profit in BC, which provides some additional breathing room.

After implementing the EHT, BC will still have low payroll taxes compared to other provinces.

For a concrete example of how the EHT works, consider how it applies to us at the CCPA-BC. We’re a non-profit charity with 15 staff members and we’ve always paid MSP premiums for staff members. That means CCPA-BC will save about $17,000 per year from the elimination of the MSP. We had originally expected to pay about $10,000 per year in the new EHT, which would partly offset those savings (but still leave us better off). With the recently announced higher threshold for charities and non-profits, though, we’ll be exempted from the EHT entirely.

Staff members as individuals will also realize a small boost from the shift away from the MSP. Our employer covers our MSP premiums, but this is classified as a taxable benefit. With no more MSP, we won’t be paying the tax on the benefit of having MSP covered. Of course, the same goes for other workers in BC who have had MSP covered by their employers.

When it comes to replacing the MSP with the EHT, we still see one outstanding problem.

As noted above, CCPA has long called for eliminating the MSP, but we’ve also argued forcefully that the revenue should be fully replaced with fairer taxes.

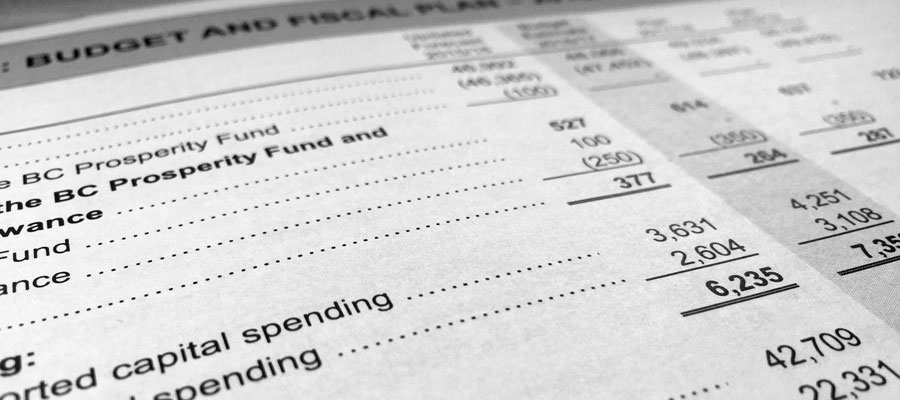

With the EHT, the government is only replacing $1.9 billion of the $2.6 billion in foregone MSP revenues annually. Indeed, in their official press release, the government trumpets this as “a net reduction in taxation” of $800 million. (The tax reduction looks closer to $700 million based on the estimates in Budget 2018, but put that discrepancy aside for the moment.)

Given the pressing economic, social and environmental needs facing BC, reducing our province’s fiscal capacity should not be an option.

If charities and non-profits have a payroll under $1.5 million they’ll pay no EHT.

When measured as a share of the economy, provincial government revenue has declined markedly since the late 1990s. Under BC’s new government, this decline has levelled off but has not been reversed. Thus, shoring up our fiscal capacity should be a high priority.

One way to close the revenue gap between the MSP and the EHT would be a new top tax rate of 22% on incomes over $200,000, which we recently recommended in our submission on Budget 2019 to the Legislature’s Standing Committee on Finance and Government Services. This measure alone would add over $500 million in provincial revenue annually while only affecting the most affluent tax filers. We have previously modelled options for replacing the entirety of the MSP revenue, and we believe there are ideas in the final report of the MSP Task Force worth consideration.

There’s no question that eliminating the MSP and replacing it with the EHT is a major step forward for tax fairness in BC. Refinements to the EHT policy as it moves towards implementation have also been sensible. What remains is to bridge the revenue gap and ensure that BC has the resources to invest in services to tackle the major social, economic and environmental challenges we face.

Topics: Economy, Health care, Taxes